34+ can i deduct interest on mortgage

Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. However higher limitations 1 million 500000 if married.

Business Succession Planning And Exit Strategies For The Closely Held

So lets say that you paid 10000 in mortgage interest.

. For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. You must also have a. Web You cant deduct the principal the borrowed money youre paying back.

Web 4 hours agoFor tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web If your home was purchased before Dec. Discover The Answers You Need Here.

15 2017 taxpayers can deduct interest on a total of 750000 of debt for a first and second home. Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web If your mortgage was in place on December 14 2017 you can deduct interest on a debt of up to 1 million 500000 each if youre married and file separate. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web Keep in mind that mortgage points arent the only deduction you can claim as a homeowner. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Most homeowners can deduct all of their mortgage interest.

If you took out. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction.

That cap includes your existing. Earned Income Tax Credit EITC. Web Can I deduct 34ths of my house costs mortgage interest property taxes from my rental income.

Web 8 hours agoHowever you are allowed to deduct the 765 employer portion of Social Security taxes which can help reduce the sting a bit. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. If you are single or married and.

The IRS says I can either divide by square footage dedicated to rental or by. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. Web Important rules and exceptions.

Web You may deduct in each year only the interest that applies to that year. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. Mortgage interest paid on a home is also deductible up to certain.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web 2 days agoMortgage Interest Tax Deduction Limit. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

However an exception applies to points paid on a principal residence see Topic No. Web For new mortgages issued after Dec. In addition to itemizing these conditions must be met for mortgage interest to be.

Web With the home interest mortgage deduction HIMD homeowners have the opportunity to deduct the amount of mortgage interest paid throughout the year from. And lets say you also paid. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

25 Best Property Management Company Near San Diego California Facebook Last Updated Mar 2023

Business Succession Planning And Exit Strategies For The Closely Held

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

June 2012 Complete Issue Edinburg Newsletter

How To Optimize Your Mortgage Under The New Tax Law Aspiriant

Mortgage Interest Deduction Rules Limits For 2023

What Is Mortgage Interest Deduction Zillow

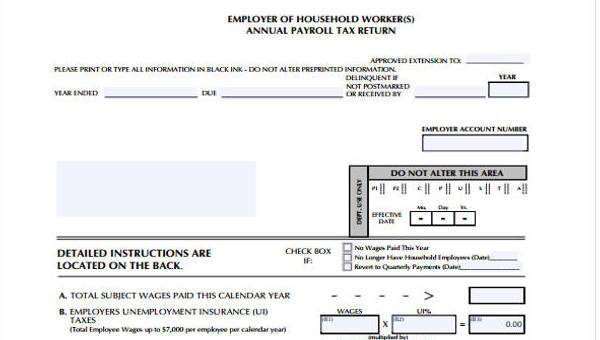

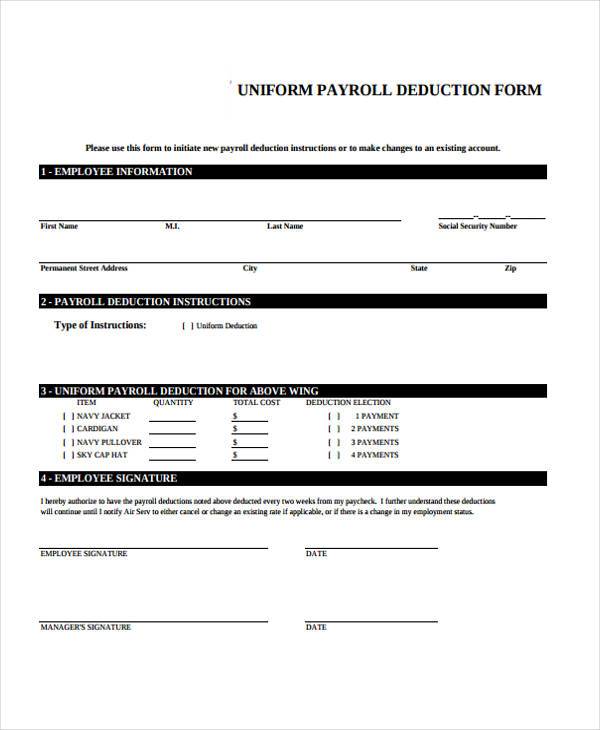

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Home Mortgage Loan Interest Payments Points Deduction

Can I Still Deduct My Mortgage Interest

Srg Housing Finance Ltd Home Loan Interest Rate Starting 15 P A

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

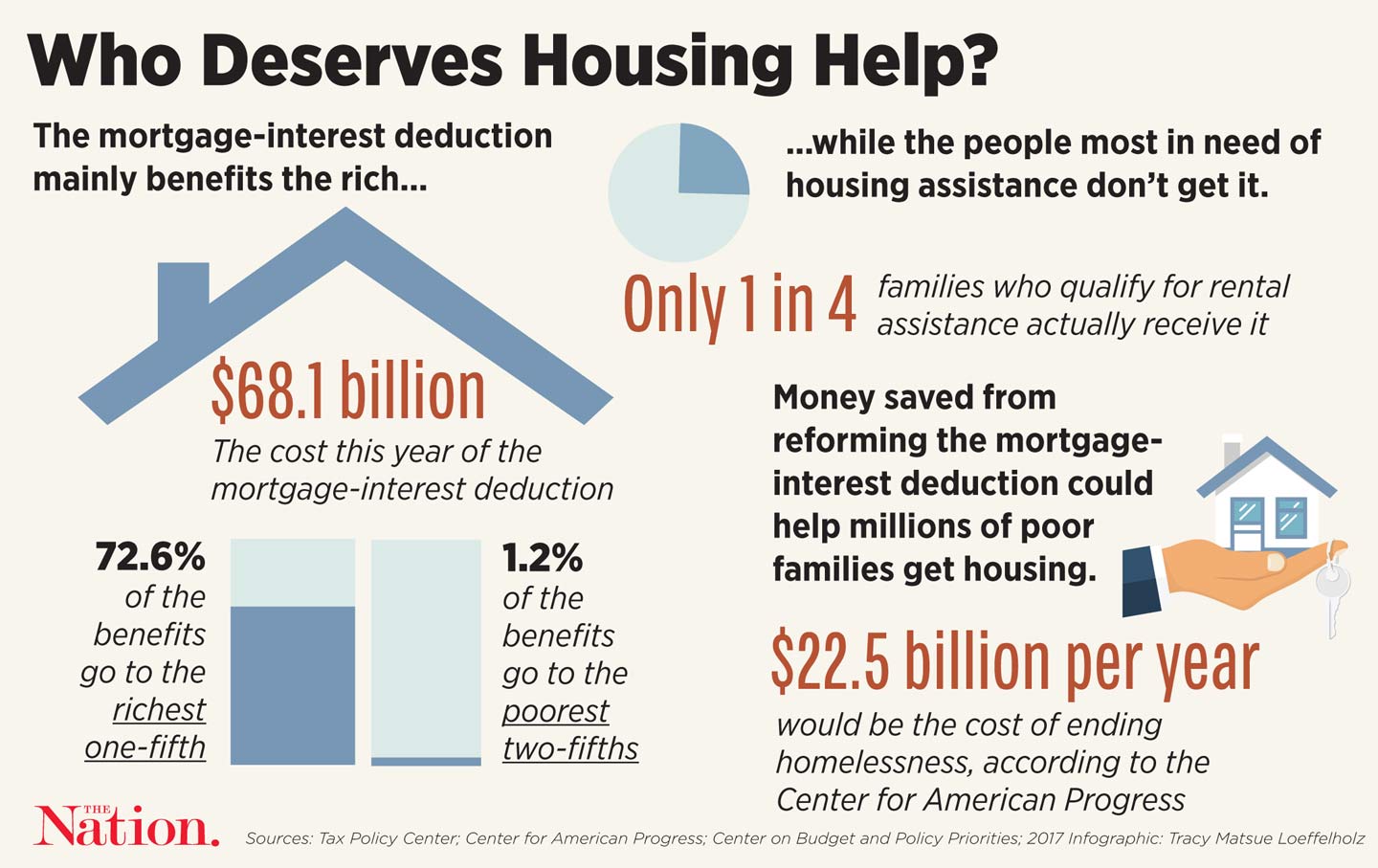

Gentrification And The Affordable Housing Crisis The Responsible Consumer

Mortgage Interest Deduction Bankrate