Estimated tax penalty calculator

File your tax return on time. Underpayment of Estimated Tax Penalty Calculator.

What Happens If You Miss A Quarterly Estimated Tax Payment

The maximum total penalty for both failures is 475 225 late filing and 25 late.

. If you pay 90 or more of your total tax from the. Calculating Your Estimated Payments. Use electronic funds transfer to make installment payments of estimated tax.

Visit Tax Coloradogov for additional information regarding the estimated tax penalty. The IRS charges a penalty for various reasons including if you dont. Calculate Form 2210.

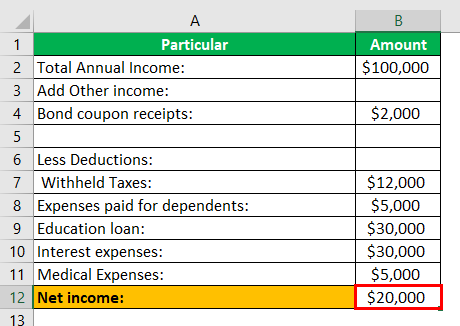

Based on the tax brackets for 2022 for a single person we can calculate your estimated income tax like this. 10 on your income up. Deduct the Personal exemption.

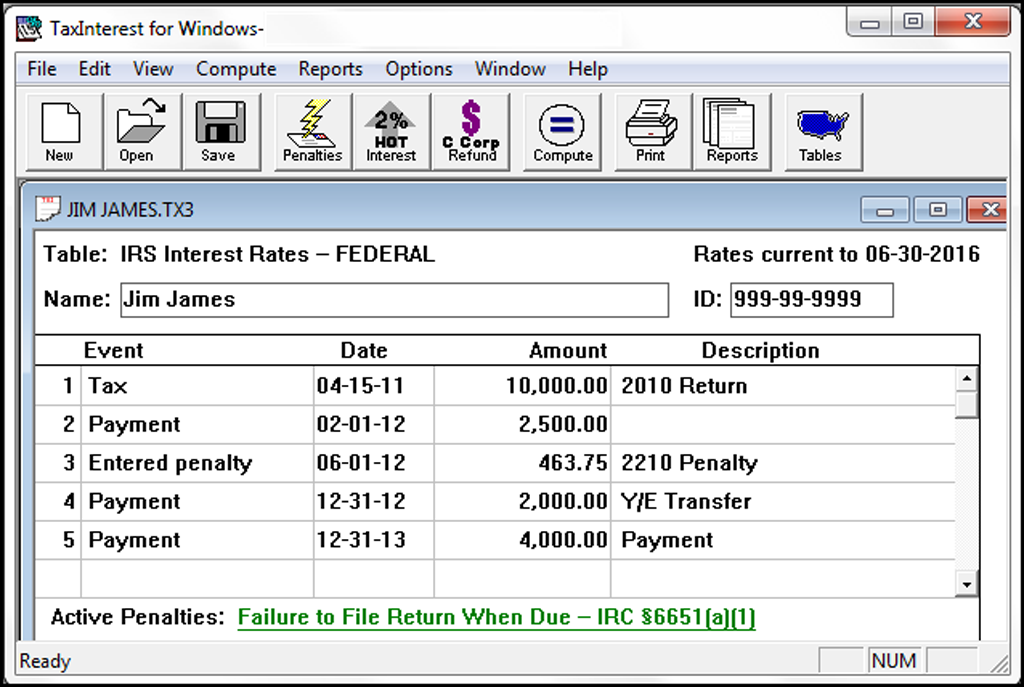

The penalty rate for estimated taxes in 2020 is 5. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. The underpayment of estimated tax penalty calculator prepares and prints Form 2210.

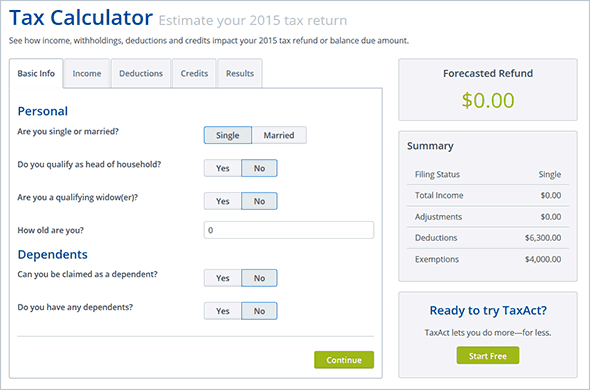

The maximum penalty is 25 of the additional taxes owed amount If both the failure-to-file and the failure-to-pay penalties are owed for the same month the failure-to-pay. The estimated tax safe harbor rule means that if you paid enough in tax you wont owe the estimated tax penalty. Standard deduction for a single person 6350.

Deduction for half of the self-employment tax 565182. For the year 2022 the IRS charges a penalty of 3 which is based on the current interest rate or you can use FlyFins IRS penalty calculator. The IRS changes the penalty.

This is because daily penalties are not being charged for the 2018 to 2019 tax year because of. Unpaid tax is the total tax required to be. For the federal income tax returns the maximum tax penalty can be 475 percent of the tax.

Taxpayers who dont meet their tax obligations may owe a penalty. To avoid the IRS underpayment penalty you. Trial calculations for tax after credits under 12000.

This rate remained unchanged until the 1st of April 2021 when the penalty became 3. We calculate the penalty on the unpaid amount from the due date of the estimated tax installment to the following dates whichever is earlier. If your 2018 to 2019 tax return is more than 3 months late your calculation may be wrong.

How We Calculate the Penalty. Who Must Pay Estimated Tax. Thus the combined penalty is 5 45 late filing and 05 late payment per month.

We calculate the Failure to Pay Penalty based on how long your overdue taxes remain unpaid. The date we receive. TaxInterest is the standard that helps you calculate the correct amounts.

The maximum late-filing penalty is. Paying quarterly estimated taxes can help you avoid penalties and a huge tax bill when filing your return with the IRS. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Recommends that taxpayers consult with a tax professional. This percentage refers to both the payment and filing penalty. If you didnt pay enough tax throughout the year either through withholding or by making estimated tax payments you may have to pay a penalty for underpayment of.

We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you. Use Form 1120-W Estimated Tax for Corporations as a worksheet to calculate your estimated. Form 2210 calculator for taxpayers who are liable to pay penalty for underpayment of estimated tax is based on the section 6654 of the Internal Revenue Code.

Here are the rules. You can use Form 2210 Underpayment of Estimated Tax by Individuals Estates and Trusts as well as a worksheet from the Form 2210 Instructions to calculate your penalty. 20020419999 DR 0204 110520 COLORADO DEPARTMENT OF REVENUE.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The penalty for not doing your taxes is typically around 5 of the tax you owe increasing by 5 each month until reaching a maximum failure to file penalty of 25. Whats next The next estimated quarterly tax due.

Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of.

What Happens If You Miss A Quarterly Estimated Tax Payment

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Excel Template Tax Liability Estimator Mba Excel

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Excel Template Tax Liability Estimator Mba Excel

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

How To Calculate Estimated Taxes The Motley Fool

Strategies For Minimizing Estimated Tax Payments

The Complexities Of Calculating The Accuracy Related Penalty

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Estimated Tax Definition Calculation Examples Penalties

Calculate Estimated Tax Penalties Easily

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving