Conventional mortgage calculator with taxes and insurance and pmi

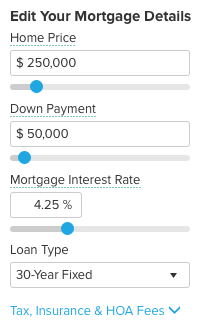

Redfins mortgage calculator estimates your monthly mortgage payment based on a number of factors. Which meant that borrowers could make smaller down payments to get into a home.

What Is Pmi Understanding Private Mortgage Insurance

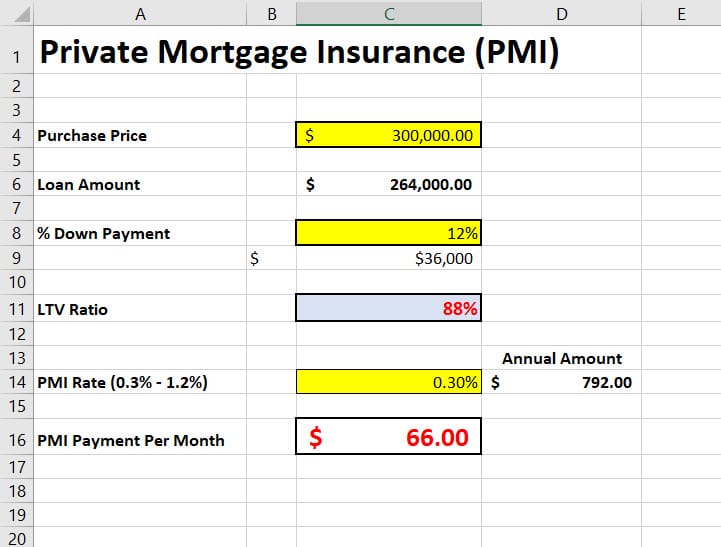

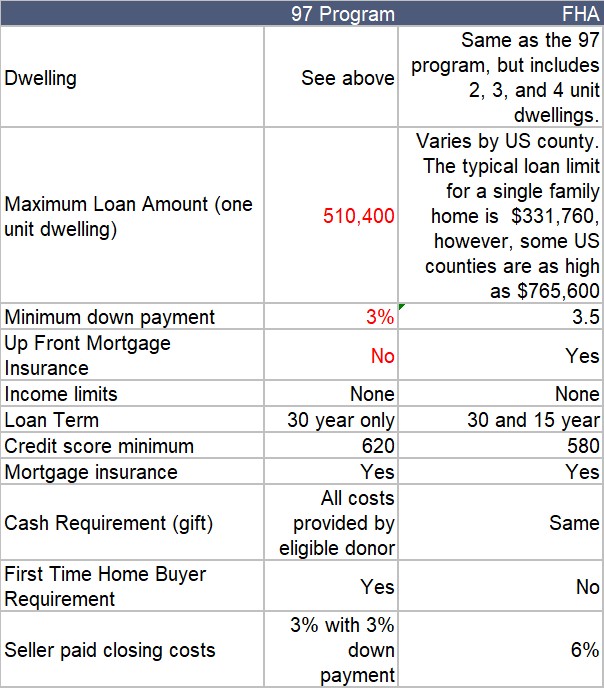

Private Mortgage Insurance PMI PMI is often required on conventional loans when the down payment is less than 20 of the purchase price.

. Hopeful homeowners have a number of agencies to turn to in California. Mortgage insurance was created to enable lenders to do higher loan-to-value loans while mitigating risk. A conventional mortgage which is a loan issued by a bank might have a higher PMI than an FHA loan for example.

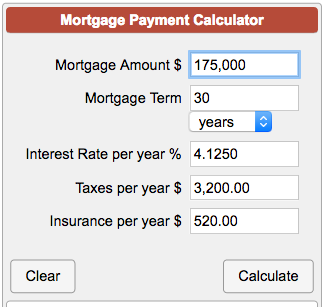

However once you reach 20 equity in your home you can request that your lender or servicer remove PMI from your mortgage. While 20 percent is thought of as the standard down. The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Use SmartAssets mortgage calculator above to estimate your monthly mortgage payment including your loans principal interest taxes homeowners insurance and private mortgage insurance PMI. There are several types of mortgage insurance but PMI only applies to conventional non-government lending.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Your homeowners insurance premium is divided by 12 to calculate this monthly amount. It can be canceled at 80 loan-to-value ratio LTV or removed automatically at 78 LTV.

MIP mortgage insurance premium is. The lender will require you to get PMI or insurance for your loan if you decide to put less than 20 down payment of the total loan amount. How much to put down.

Our mortgage calculators payment breakdown can show you exactly where your estimated payment will go. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. A monthly mortgage payment is made up of many different costs.

Your mortgage payment includes your principal and interest down payment loan term homeowners insurance property taxes and HOA feesThis gives you the ability to compare a number of different home loan scenarios and how it will impact your budget. See how changes affect your monthly payment. The cost of PMI varies greatly depending on the provider and the cost of your home.

PMI private mortgage insurance is applied to conventional loans. Any borrower with a conventional loan who puts less than 20 down is required to buy private mortgage insurance PMI which raises the annual cost of the loan. If you make less than a 20 down payment the estimated monthly PMI.

Unless you come up with a 20 percent down payment or get a second mortgage loan you will likely have to pay for private mortgage insurance. The Rocket Mortgage calculator takes those taxes into consideration when giving you an estimated monthly mortgage. The calculator divides your annual property taxes by 12 to calculate this monthly amount.

Based on recent PMI rates from mortgage insurance provider MGIC this is a fee you pay on top of your mortgage payment to insure the lender against loss. For example most lenders like to see a DTI ratio of 43 or less for a conventional loan although under some circumstances lenders will tolerate a DTI up to 50. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Most mortgages require the home buyer purchase private mortgage insurance PMIlender in case you default. PMI insures the loan for the lender in the event the homeowner defaults. Private mortgage insurance PMI is a type of insurance that conventional mortgage lenders require when homebuyers put down less than 20 percent of the homes purchase price.

Our calculator includes amoritization tables bi-weekly savings. So if at all possible save up your 20 down payment to eliminate this. If you pay less than 20 lenders will expect you to pay PMI as part of your mortgage payment each month.

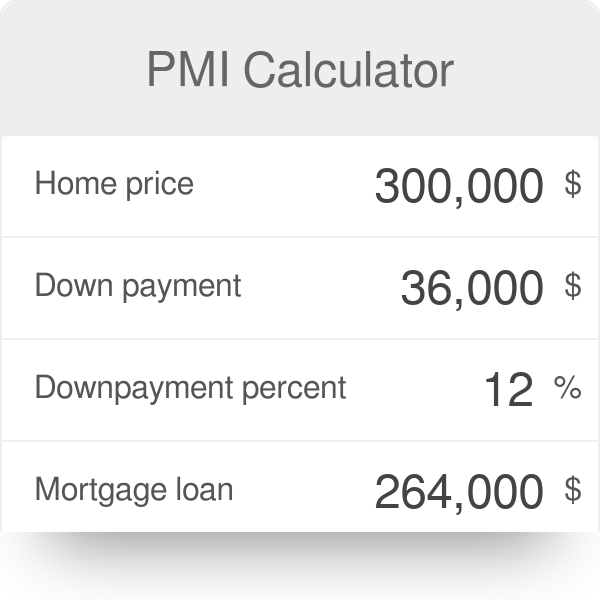

For example if the total mortgage amount is 300000 and you only have 45000 for the down payment which is 15 and is less than the required 20 then you will need to buy PMI for the home loan. About Conventional Loans Fannie Mae Freddie Mac. Check out the webs best free mortgage calculator to save money on your home loan today.

Principal and interest PI homeowners insurance property taxes and private mortgage insurance PMI. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. It does nothing for you except put a hole in your pocket.

Cancellation of mortgage insurance works differently for FHA MIP. In general MIP cant be cancelled unless you made a larger-than-average down. Using our mortgage rate calculator with PMI taxes and insurance.

When DTI is surging past 40 it could be a sign that you need to increase your income or look for a more. Do I need to get PMI. If you enter a down payment of at least 20 of the homes purchase price into the mortgage calculator Private Mortgage Insurance PMI will not be added to your monthly payment.

Tips to Shave the Mortgage Balance. Avoid private mortgage insurance. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

Otherwise PMI will be cancelled automatically once you reach 22 equity. You can adjust the home price down payment and mortgage terms to see how your monthly payment will change. To avoid paying private mortgage insurance PMI on a conventional loan lenders expect a down payment of at least 20.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. How to Use the Mortgage Calculator. An FHA mortgage is so called because it is insured by the Federal Housing.

The HOA fee is included here if applicable. The California Housing Finance Agency CalHFA has loan programs such the first mortgage conventional or CalPLUS fixed-rate loan down payment assistance programs and mortgage. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI.

PMI protects the lender in case you default on the loan. Once the equity reaches 20 of the loan the lender does not require PMI. PMI is required any time you put less than.

Homeowners must have mortgage loans insured by CalHFA Mortgage Insurance on or before May 31 2009. This mortgage insurance can be. For example a 20 down payment on a 300000 home is 60000.

Conventional loans are often referred to as conforming loans.

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Mortgage Calculator With Taxes Insurance And Pmi Top Sellers 50 Off Www Ingeniovirtual Com

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator With Taxes Insurance And Pmi Top Sellers 50 Off Www Ingeniovirtual Com

Mortgage Calculator With Taxes Insurance And Pmi Hotsell 55 Off Www Ingeniovirtual Com

Mortgage Calculator Estimate Your Monthly Payments

Mortgage Calculator With Taxes Insurance And Pmi Hotsell 55 Off Www Ingeniovirtual Com

Mortgage Calculator With Pmi Online 55 Off Www Wtashows Com

What Is Pmi Understanding Private Mortgage Insurance

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Pmi Calculator Mortgage Insurance Calculator

Conventional 97 Loan And Calculator Anytime Estimate

Mortgage Calculator With Taxes Insurance And Pmi Hotsell 55 Off Www Ingeniovirtual Com

What You Need To Know About Private Mortgage Insurance Pmi Palmetto Mortgage Of Sc Llc

Mortgage Calculator With Taxes Insurance And Pmi Top Sellers 50 Off Www Ingeniovirtual Com

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow